An Introduction To The Nickel Ore Global Market

Nickel, a shiny, silvery basic metal, is an important and ubiquitous material because of its many useful applications. The question is, "Where does it originate from?" And what are the specific uses that make this so important?

Investors in the world Nickel market might benefit from knowing the responses to the above questions. After all, it's impossible to make wise, lucrative investment selections without first gaining a thorough familiarity with the space's dynamics.

Here's a quick primer on the Nickel industry, including such topics as where it's discovered, what it's used for, and which countries consume the most.

The Variety of Nickel Deposits and Their Locations

Both laterite and sulfide deposits can be found in the crust of the Earth and contain Nickel ore. Recent research on Nickel by the US Geological Survey estimates that there are at least 300 million metric tons (MT) of Nickel in laterite deposits and 40 MMT in sulfide deposits, with the former accounting for around 60 percent of the total.

Nickel mining is complicated by a wide variety of factors, depending on the type of deposit being exploited. Sulfide deposits are typically located well below the surface of the Earth's crust, making their extraction a challenging task. Also, unlike laterite deposits, they are often smaller and more grade-variable. The US Geological Survey reports that sulfide deposit discoveries have been on the wane for some time, forcing exploration companies to go in more difficult places like East Central Africa and the subarctic.

On the other hand, laterite deposits are typically found in close proximity to the earth's surface, making them amenable to open-pit mining. They are larger than sulfide deposits, have more dependable grades, and are more common. One possible drawback of laterite deposits is that ore extraction often necessitates the use of acids and high temperatures.

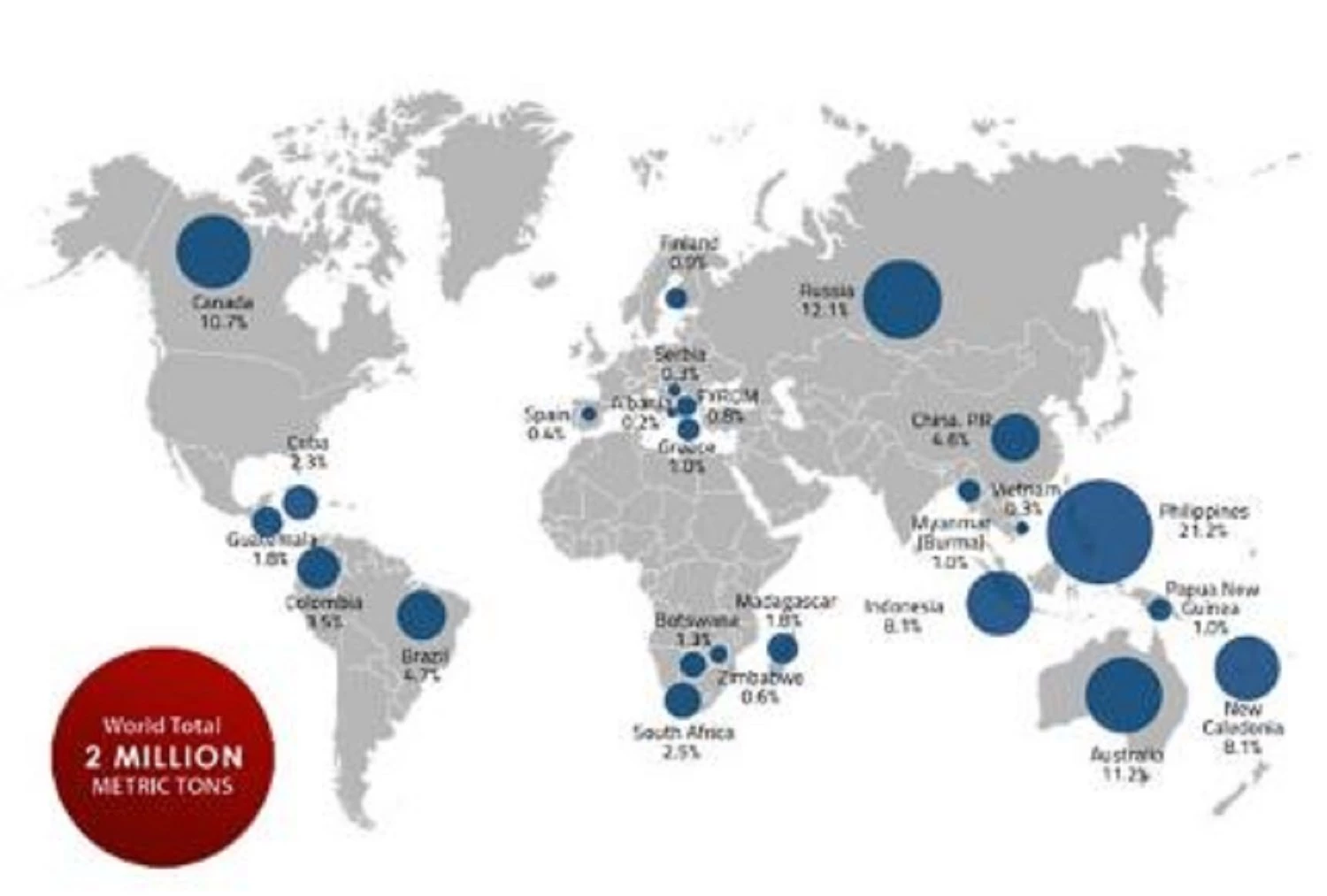

Indonesia, the Philippines, Russia, and New Caledonia were the top five countries of the world Nickel market in 2021. New Caledonia provided 190,000 MT of the metal, while Russia produced 250,000 MT, the Philippines produced 370,000 MT, and Indonesia produced 1,000,000 MT. Two of the biggest Nickel manufacturer are Glencore and Vale.

Despite the fact that stainless steel is still the primary consumer of Nickel, it is important to note that Nickel is a leading battery metal and is widely utilized in lithium-ion batteries that provide energy for electric vehicles (EVs).

Nickel is expected to overtake palm oil as Indonesia's second largest industry as a result of the growing demand for electric vehicles. According to Forbes, the country is on course to increase its share of global Nickel output from 28% in 2021 to 60% in 2029.

High Need for Nickel in Electric Vehicles and Other Infrastructure

More than two-thirds of the Nickel Ore Global Market is utilized to make stainless steel, which is the primary usage for the refined metal once Nickel ore has been mined. Due to its high corrosion resistance, refined Nickel is highly valued by the aerospace sector and used extensively in the production of superalloys. Coins, catalysts and chemicals, foundry products, and plating are some of the other applications for the metal.

Increases in Nickel consumption are frequently driven by emerging countries that are in the midst of infrastructural expansions, as stainless steel is the main source of demand for Nickel. Nickel's price has risen and fallen dramatically since the early 1990s as the economy has expanded and contracted.

For instance, global Nickel ore price plummeted after the fall of the Eastern Bloc, and it didn't recover until the beginning of the 21st century. After the market recorded a deficit of 44,000 MT the year prior, Nickel reached a high of US$54,050 per MT in May of 2007.

As the globe works to cut carbon emissions in the fight against climate change, the usage of Nickel in electric vehicle battery cathodes may prove beneficial to Nickel prices in the future. According to the International Energy Agency, the demand for Nickel from the electric vehicle battery industry would expand more than 40-fold by 2040, despite currently being a very insignificant market segment.

Investment takeaways from Nickel

For international Nickel ore buyers Exchange-traded products (ETPs), futures, physical metal, and stocks are the four ways to invest in Nickel.

The Invesco DB Base Metals Fund and the iPath Series B Bloomberg Industrial Metals Subindex Total Return ETN are only two examples of diversified metals exchange traded products that incorporate Nickel. Among the metals that you can gain exposure to with these products are copper, zinc, and aluminum. The iPath Bloomberg Nickel Subindex Total Return ETN, which is pegged to a benchmark for Nickel futures, could be a good option for investors looking for concentrated exposure to the metal.

The London Metal Exchange is where international Nickel ore buyers may buy and sell Nickel futures with the ticker symbol "NI." These Nickel futures contracts are priced in US dollars per metric ton and reflect a quota of 6 metric tons of Nickel. The US dollar, yen, British pound, and European Union currency euro are all acceptable for clearing.

Though it could be tempting to gain exposure to Nickel by purchasing and owning the metal itself, keep in mind that doing so would likely be difficult.

Shares of firms involved in Nickel production, exploration, and extraction are now available to investors. However, several junior firms are also actively looking for the base metal around the world. Some notable Nickel miners traded on the TSX are First Quantum Minerals, Lundin Mining,and Hudbay Minerals.

For more information on Philippine Nickel visit Hallmark Development Corporation a Nickel manufacturer in the Philippines.